In 2022, it’s becoming more apparent that blockchain technology is not only here to stay but has the powerful ability to change the world in ways we previously could never have imagined.

As well as its base use as a system used to securely and efficiently transfer crypto-assets, blockchain technology has taken on a new and exciting role outside the realms of decentralized finance.

From healthcare and voting mechanisms to video games and royalties for various artists, blockchain has the ability to transfer numerous aspects of our daily lives. But two of the critical foundations of any blockchain technology are two blockchain consensus models called proof of work and proof of stake.

Proof of work and proof of stake is utilized across the world of crypto trading and investing in order to ensure the validity of transactions. In the world of proof of stake, crypto enthusiasts electronically mine cryptocurrencies in order to validate new transactions on a blockchain. On the other hand, Proof of Work sees crypto users solve intricate cryptographic mathematical equations through computer power.

We get it. For a newcomer to the world of crypto, this can be a daunting concept to get to grips with. But fear not! Today, we will explain everything you need to know when it comes to proof of work vs. proof of stake in the simplest way possible. We’ll be covering things like

- The differences, roles, and unique abilities of both proof of stake and proof of work.

- Answering frequently asked questions about the two consensus mechanisms.

- How the two consensus mechanisms differ wildly when it comes to energy consumption and the threat of cyber attacks.

And, of course, much more! So join us on an exciting journey into blockchain technology’s mind-blowing past, present, and future.

By the end of this guide, you’ll be well-versed on everything there is to know when it comes to PoS vs. PoW. Now, let’s begin!

- What Is the Proof of Work Consensus Mechanism?

- How Are Transactions Verified Under PoW?

- Where Else Is Proof of Work Used?

- Pros and Cons of PoW

- What Is Proof of Stake (POS)?

- How Are Transactions Verified: PoS

- Long-Term Goals of PoS

- Pros and Cons of PoS

- Proof of Stake Examples

- So, How Do the Consensus Mechanisms of Proof of Work and Proof of Stake Compare?

- Proof of Work (POW) vs. Proof of Stake (POS) – Energy Efficiency

- POS Mechanisms vs. POW Mechanisms – Security When Verifying Transactions

- Frequently Asked Questions About POS vs. POW

- Conclusion

What Is the Proof of Work Consensus Mechanism?

First, let’s start by delving into the first consensus mechanism to hit the scene: proof of work! The proof of work (POW) concept was born in 1993 and was the brainchild of Moni Naor and Cynthia Dwork.

Its original aim was to provide a counter against denial-of-service attacks and persistent spam on computer networks. But in 2004, it was expanded upon by a man named Hal Finney, who extended proof of work into a new role of providing a level of security for digital assets. In 2009, Finney’s idea was implemented when Bitcoin adopted it. But how does it all work?

Put simply, the proof of work (POW) model has a significant competitive aspect to it. This consensus mechanism sees crypto miners go head to head in competition with one another in order to solve complex mathematical equations using high-powered computer systems.

The aim is to be the first miner to solve the equations. Those who do are then granted the ability to authenticate and add new blocks to the chain. In turn, they receive cryptocurrency as a reward for their efforts.

Due to the inherent nature of proof of work, this consensus mechanism needs computers that boast an increasingly more significant amount of speed. As a result, proof of work has developed a reputation as being environmentally unfriendly due to the enormous amounts of energy it consumes.

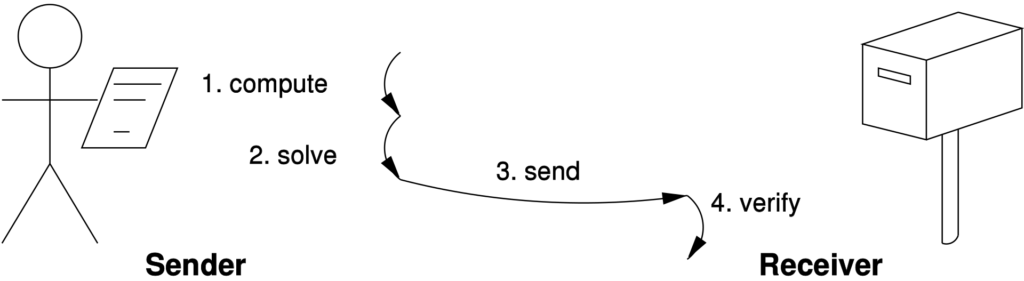

How Are Transactions Verified Under PoW?

OK, that’s the basis of proof of work covered. But without seeing POW in action, it can be challenging to figure out how it works. So next up, we will look at a detailed case study of how transactions are verified under the proof of work consensus mechanism by using Bitcoin as an example.

Stage 1) On average, a new block is created within the Bitcoin ecosystem every ten minutes. This is about the same amount of time required to validate Bitcoin transactions.

Stage 2) Whenever a new block is created, each one contains unique transactions that must be verified and validated. Because BTC is inherently decentralized, it is a huge task both time and energy-wise to correctly verify every transaction that takes place. This is where proof of work comes in.

Stage 3) Proof of work solves this drain on time and resources by providing enormous computing power to figure out the cryptographic algorithm. Those who participate in the network process are often referred to as miners and are rewarded based on the resources they have on offer to solve the algorithm quickly.

Stage 4) When the transactions within a block are wholly verified, they are added to the publicly-accessible blockchain. Once there, all other network users have the ability to view them.

Now, to reinforce your understanding of these four stages, let’s put them into practice with an easy-to-follow example: 10 + 10 using the proof of work consensus mechanism.

We know the answer to this is 20. But under the proof of work system, the first person to get the right answer is the one who receives the crypto reward. So let’s say, for example, that Miner A and Miner B are in competition with each other to solve this mathematical issue first. Here are their results:

Miner A

- First Attempt: 10+10 = 11 Incorrect

- Second Attempt: 10+10 = 9 Incorrect

- Third Attempt: 10+10 = 10 Incorrect

Miner B

- First Attempt: 10+10 = 13 Incorrect

- Second Attempt: 10+10 = 20 Correct

- Third Attempt: 10+10 = 14 Incorrect

Well done, Miner B! As you can see, this miner successfully solved the mathematical equation on their second try. But their number of attempts often isn’t the deciding factor in winning the reward; it’s all about time.

Dedicated crypto miners will often invest huge amounts of capital into building a network of high-powered computers that can solve mathematical problems in crypto in seconds. Put simply, it is a time-sensitive race to be the first one to solve it and receive your crypto reward.

Where Else Is Proof of Work Used?

While Bitcoin is a great example of Proof of Work, it is far from the only model that uses it. Next, let’s delve into some useful examples of daily products and services that have adopted the proof of work consensus mechanism.

Emails

First is an example of proof of work that we’re all well-acquainted with: emails! Millions of emails are sent around the world daily. Normally, the global computer network can handle this traffic with ease. But when the network is burdened with a plethora of other tasks and spam emails, its speed and efficiency can be drastically affected. This is where proof of work steps in. POW assists the global computer network by beefing up security and weeding out spam emails.

DDoS

Distributed Denial of Service (DDoS) is an increasingly common form of cyber-attack used by online criminals worldwide. The aftermath of a DDoS can cause major outages and disruptions. By solving intricate mathematical problems, Proof of work can counter them or prevent them altogether.

Pros and Cons of PoW

Proof of work certainly has its benefits, but it’s not without flaws. In this section, we will delve into what are widely considered to be the most significant pros and cons of proof of work.

| Pros | Cons |

| Proof of work boasts a high level of proven security for crypto users and miners. | The mining equipment required is expensive, and this makes it not beginner-friendly. |

| Proof of work provides a decentralized method of verifying blockchain transactions. | The excessive energy usage of POW means it is not environmentally friendly. |

| Crypto miners have the ability to earn cryptocurrency as a reward for their work. | It sometimes comes with high fees and slow transaction speeds. |

What Is Proof of Stake (POS)?

Now, let’s talk about Proof of Stake. This consensus mechanism came after Proof of Work first hit the scene in 2012 and was the brainchild of Sunny King and Scott Nadal. Their goal was to fix the ongoing issue associated with Bitcoin, which was the high energy consumption. In 2012, sustaining the BTC network cost around $150,000 every day.

But this wasn’t all. There was a wide range of concerns surrounding proof of work. So, proof of stake (POS) was created to provide a unique alternative to issues such as:

- The amount of energy consumed by proof of work and the subsequent impact on the environment.

- Proof of Work was seen to have a high level of vulnerability to cyber attacks.

- An increasing number of questions and concerns about the overall scalability of proof of work.

So how does it work? 5 is very simple to explain. Where POW revolves around what is known as miners who, unlike a conventional miner, solve intricate maths problems that verify transactions in a particular cryptocurrency. When the desired digital coin is mined successfully, the miner receives a certain amount of the asset in return.

Within the proof of stake consensus, miners (or stakers) instead have to stake a particular amount of their digital currency before they are allowed to validate transactions. The amount of digital coins a miner owns determines the amount of power they have. These participants are randomly selected for each transaction according to a unique algorithm.

So, to sum up proof of stake (POS) simply:

- Proof of stake is a consensus algorithm that was created back in 2012 in response to energy and vulnerability concerns surrounding proof of work. Under PoS, crypto miners stake their crypto assets in order to validate transactions.

- An algorithm randomly selects miners, but those who have a more significant stake or a long record of staking crypto on the network are given priority.

- Once the algorithm has chosen them, all of the miners must agree to verify the valid blocks in the blockchain transactions in question.

- Once the valid block in the blockchain transaction has been verified by the miners, they then receive a reward in the form of their chosen digital asset once the block has been added to the chain.

- If the block is incorrectly verified, the miner’s stake will be affected, and they may lose their stake and block reward. The reason behind this is to ensure a higher level of security to the proof of stake process and to remove the temptation to steal coins or carry out fraudulent behavior.

How Are Transactions Verified: PoS

Again, understanding how proof of stake works is one thing, but to see it in action is another. So let’s delve into a great example of proof of stake in action further to strengthen your understanding of this popular consensus mechanism. Because when compared to proof of work, it is inherently different.

With proof of stake, the forming of a new block is determined by how much a network participant stakes. This is based on the number of crypto assets the participant owns and is willing to potentially stake on the network to receive more in return.

Instead of mining like with proof of work, network participants are not rewarded with cryptocurrencies in the proof of stake system. The way it works is straightforward.

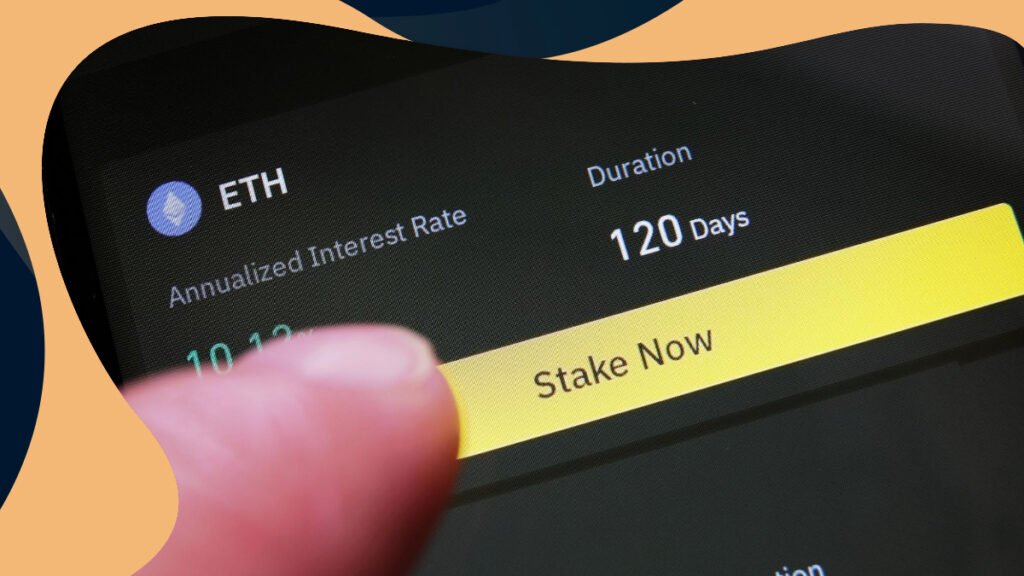

When a network participant wishes to start the staking process, they are required to deposit their chosen amount of crypto assets into a digital wallet that then places a hold over them. Then, the coins are essentially frozen for the purpose of being staked on the network.

Just as proof of work requires an initial investment in the form of computing hardware, proof of stake requires an initial investment of a minimum crypto requirement to begin staking. Let’s look at an example of proof of stake in action by using the popular POS-based cryptocurrency called Dash (DASH).

Stage 1) The initial stage is dependent on the network participant. They must decide on how much of their chosen crypto asset, DASH, in this case, to deposit as a stake.

Stage 2) Then, the network participant must figure out how many digital coins a particular network has in circulation in the blockchain. DASH has over 10,000,000 coins in circulation.

Stage 3) The network participant must buy their chosen crypto asset and stake the required amount. The latter varies wildly depending on the crypto network you’re staking in.

Stage 4) Then, it’s time for the best part: receiving the rewards you’re owed for staking your crypto! Naturally, the more crypto coins a network participant deposits, the more potential rewards they will receive.

Long-Term Goals of PoS

It may be the younger addition when it comes to consensus mechanisms, but Proof of Stake has noble long-term goals. Its primary mission is to tackle the concerns associated with the proof-of-work (PoW) protocol, such as energy consumption, scalability, and the negative effect on the environment.

After all, proof-of-work is primarily seen as a competitive method of verifying blockchain transactions. With PoW, monetary rewards incentivize miners, which naturally means they constantly seek methods to gain an advantage over other miners.

Take Bitcoin as one of the real-world examples which use PoW. The miners who focus on the original cryptocurrency complete complex mathematical problems to verify blocks and confirm transactions in order to earn BTC on the Bitcoin blockchain as a reward. But with the average cost of mining one Bitcoin currently between $7,000-$11,000, Bitcoin miners consume a lot of energy and are an expensive affair. Naturally, miners need to cover a lot of operating expenses in order to make the most money.

So what then happens is that miners exchange high energy consumption levels for cryptocurrencies like Bitcoin. This is not sustainable and has enormous effects on the market dynamics of pricing and profitability of PoW.

So to solve these issues, the proof of stake mechanism successfully replaces computing power with staking. The mining ability of crypto enthusiasts is randomized and they’re not given an advantage based on energy-draining farms of crypto mining hardware, thereby causing a reduced level of energy consumption.

Pros and Cons of PoS

At first glance, it certainly looks like proof of stake has the upper hand over proof of work, especially when it comes to energy consumption and sustainability. But does it have downsides? Let’s look at the pros and cons of PoS!

| Pros | Cons |

| PoS is more beginner-friendly as it doesn’t require specialist crypto-mining hardware to get started. | Miners with significant investments in crypto can secure an enormous influence on the verification of transactions. |

| PoS is a high-speed and inexpensive method of processing crypto transactions. | Some proof-of-stake cryptocurrencies require you to lock staked coins on the network for a specific period. |

| Proof of Stake is much more energy-efficient than Proof of Work. | When compared to PoW, PoS doesn’t have a proven track record of reliable security. |

Proof of Stake Examples

Often seen as a much more improved method to solve cryptographic problems on the blockchain, proof of stake is often the go-to consensus mechanism of choice for the more recent crypto projects to hit the world of decentralized currency. The following are some examples of well-known blockchains that currently use POS.

Binance Coin:

Binance Coin (BNB) is the native coin of the popular cryptocurrency exchange Binance and uses the proof of stake consensus model to significant effect. Its price has risen enormously in recent years and secured a wave of new users to its network and exchange alike. It’s also one of the most straightforward ways to take advantage of POS and start staking coins for rewards. Binance token holders who stake their BNB often earn up to 30% back on their initial stake. The Binance crypto exchange even has its own native staking vault that users of the exchange widely use.

Tezos:

Tezos is a well-known and very successful crypto project that has used the proof of stake consensus model to good effect. The Tezos network boasts a popular incentive mechanism that sees validators generously rewarded with newly-created Tezos coins. And rightly so. After all, these validators play a significant role in the maintenance and security of the Tezos network. Based on the number of new network participants, the stakes required by the Tezos network increase in turn. Thanks to POS, the rewards and data on the Tezos blockchain are securely protected from fraudulent activity.

Ethereum 2.0:

One of the most well-known blockchain assets is that of Ethereum. Since its release, its price has skyrocketed and even rivalled that of Bitcoin on many occasions. Ethereum has boomed in recent years and has since become the foundation of thousands of blockchain projects. As a result of this success, it has become a congested network and is in dire need of scaling. To solve this issue, Vitalik Buterin, one of the co-founders of Ethereum, devised a plan for Ethereum 2.0 in 2016. It consisted of a revamped version of the proof of work algorithm called Sharding. Under Ethereum 2.0, those who hold or buy ETH have the chance to stake it on the network in exchange for a range of cryptocurrency rewards.

Cosmos:

The popular crypto project Cosmos has aspirations to become the most prominent and most widely-used decentralized coin based on the proof of stake model. It has secured millions of users due to its widespread ability to utilize POS for a wide range of uses. Overall, Cosmos targets millions of people worldwide who do not have access to the global banking system. By using the POS model, Cosmos users have the chance to stake their coins in exchange for rewards.

Akash Network:

And last but by no means least is Akash Network. Its native utility Akash Token (AKT), can be staked on the Akash Network and offers network participants the chance to earn over 55% APR. Akash provides one of the highest staking rewards on the crypto market.

So, How Do the Consensus Mechanisms of Proof of Work and Proof of Stake Compare?

Okay, we’ve dived deep into the main differences and pros and cons of proof of work and proof of stake, but how do they compare? The two compete in two main areas: Energy efficiency and security. Let’s take a look at both.

Proof of Work (POW) vs. Proof of Stake (POS) – Energy Efficiency

Firstly, is the crucial issue of energy efficiency. Crypto has developed a reputation as a major draw of energy and resources worldwide. But this is mainly due to the proof of work blockchains model, which is well-known for its massive energy usage. In 2021, for example, it was revealed that the Bitcoin network uses more electricity than all of Argentina.

This is because of the competitive nature of proof-of-work blockchains, whereby miners are required to constantly increase computational power to be the first to solve increasingly tricky mathematical problems. Proof of stake, on the other hand, is much more efficient.

With POS, those who validate blocks are chosen via a random algorithm. This results in far lower levels of energy consumption and faster transaction speeds. In addition, it also provides an additional level of security for crypto transactions and allows networks the chance to scale.

POS Mechanisms vs. POW Mechanisms – Security When Verifying Transactions

Another crucial area of any consensus mechanism is its security. Proof of work was initially founded based on an idea for increased security. By requiring miners to use more resources and go into competition with one another to solve cryptographic puzzles, process transactions, create new blocks, and earn rewards, PoW works toward preventing network attacks.

However, POW faces a significant security threat through what is known as a majority attack on a cryptocurrency network. This cyber-attack aims to take over 50% or more of the mining power on a network. Then, it has the ability to prevent the confirmation of transactions, create multiple duplicate transactions, carry out malicious transactions, and make illicit forks of the blockchain that look genuine.

POS systems, on the other hand, only permit miners to validate blocks after they have put in a stake. This stake acts as a security deposit that forces cybercriminals to legitimately verify blocks and avoid illicit forks. Because if they do, their stake will be lost and they receive no benefit. So, overall, proof of stake can be an even more effective level of security than proof of work with less energy consumption to boot.

Frequently Asked Questions About POS vs. POW

Still have questions about PoS vs. PoW? Well, we love an inquisitive reader! So allow us to answer some of the most commonly asked questions surrounding proof of work and proof of stake to further solidify your understanding of these two unique consensus mechanisms!

Will proof of stake replace proof of work?

No, both consensus mechanisms are completely different from one another and both play unique roles in the crypto space. Most notably, proof of work is a key foundation of Bitcoin which is unlikely to change anytime soon.

Is proof of work more secure than proof of stake?

Overall, proof of work is viewed as the more secure consensus mechanism when compared to proof of stake. However, the latter is considered to be faster, more energy-efficient, and more environmentally friendly than the former.

Is Bitcoin a PoS or PoW?

As the oldest cryptocurrency, Bitcoin uses the older Proof of Work consensus mechanism. So does Ethereum 1.0. Generally, the more recent cryptocurrencies such as Cardano, and Tezos use proof of stake.

What happens to proof of work-based ETH when proof of stake-based ETH 2.0 is released?

If you’re an ETH holder, don’t worry, your crypto isn’t going to disappear! When ETH 2.0 is released, it will rely on the proof of stake consensus mechanism. However, the data history of Ethereum 1.0 will be preserved, and it will be turned into one of the 64 shards that make up Ethereum 2.0.

Is XRP proof-of-stake or proof of work?

Good question! XRP is actually neither. Instead, it uses the federated consensus algorithm. This is massively different from the proof-of-work and proof-of-stake mechanisms, as participants in the Ripple network are both well-acquainted and have a basis of trust with each other based on their reputation.

Conclusion

So, to sum up this guide to proof of work vs. proof of stake, these two different consensus models play unique roles in the foundations of the blockchain. We can sum up the two consensus models as follows:

- Proof of work: Crypto miners go head to head in competition with one another in order to solve complex mathematical equations using high-powered computer systems. The first to solve the equation is rewarded with cryptocurrency in return. Highly competitive and not efficient in both speeds and energy.

- Proof of stake: Miners have to stake a particular amount of their digital currency before they are allowed to validate transactions. The amount of digital coins a miner owns determines the amount of mining power they have. Miners are randomly selected for each transaction according to a unique algorithm. Energy-efficient and less competitive.

Overall, proof of work is the more widely known blockchain consensus model and forms the foundation of the original cryptocurrency Bitcoin. However, the alternative consensus model that is proof of stake has proved itself to be a far more energy-efficient, secure, and scalable alternative.

Most of the recent blockchain projects and cryptocurrencies to hit the market have opted for the proof of stake model. But rather than competing with each other, it’s likely that the two will coexist and play unique roles in the world of crypto as they’re both inherently unique and fill different roles.

Disclaimer: This article is not financial advice. It is merely providing an insight into one of the most fascinating realms of blockchain technology. Anybody wishing to invest in cryptocurrency for the first time should be aware that it is an inherently volatile space. The prices of cryptocurrency can rise and fall at a moment’s notice and a loss is just as possible as a profit. Prior to investing in digital currencies, always do your research and seek the advice of a licensed financial professional.